Credit or CIBIL report is the financial report in which a person's borrowings from different financial institutions and banks are reflected. The report is a way of tracking credit card and loan payment history along with dues, the tenure of loan and late payments. Why the CIBIL score report can affect your employment prospect seems unlikely, but the companies take a quick look at the candidate's report before conducting the interview. Moreover, the number seems to be alarming because 60% of Indian companies do not consider hiring potential candidates with bad CIBIL score. The basic thing about the relationship lies in the fact - if you fail to manage your own finances, how can a company expect you to manage or deal with multi-million funds and budget? The human resource department does not neglect the simple correlation between job performance and credit score.

As you forget to pay utility bills, you may also forget about the game-changing business meeting. The personal issues may jeopardise the work performance and a person with the good CIBIL score is potential to handle the organisational services. Generally, mortgage lenders ask applicants for identification documents like a driver's license or Social Security card during the initial stage of the application process.

During the loan's underwriting, lenders may opt to take the verification one step further to verify an applicant's income. Some lenders request that loan applicants complete the IRS Form 4506-T Request for Transcript of Tax Return, especially if they do not have copies in their personal files. Mortgage lenders verify employment as part of the loan underwriting process – usually well before the projected closing date. An underwriter or a loan processor calls your employer to confirm the information you provide on the Uniform Residential Loan Application.

Alternatively, the lender might confirm this information with your employer via fax or mail. Some lenders simply accept recent pay stubs, or recent income tax returns and a business license for self-employed borrowers. Most loans, however, follow Fannie Mae, Freddie Mac or Federal Housing Administration loan guidelines and require a more thorough employment check.

Lenders must obtain a verbal verification of employment for each borrower using employment or self-employment income to qualify. The verbal VOE must be obtained within 10 business days prior to the note date for employment income, and within 120 calendar days prior to the note date for self-employment income. The verbal VOE requirement is intended to help lenders mitigate risk by confirming, as late in the process as possible, that the borrower remains employed as originally disclosed on the loan application.

A change in the borrower's employment status could have a significant impact on that borrower's capacity to repay the mortgage loan and must be fully reevaluated. Earlier this year, Fannie Mae issueda fraud alertwarning mortgage lenders about nonexistent companies listed on loan applications. The original wave of fake employers was generally located throughout California. Fannie Mae attempted to re-validate the employer information supplied on suspect applications and other supporting documents, such as pay stubs. When researching the employer for employment verification, several of them are listed within yellowpages.com and have other online references. Fraud alert warning mortgage lenders of nonexistent companies listed on loan applications.

Fannie Mae attempted to re-validate the employer information supplied on suspect applications and other supporting documents, i.e. pay stubs, etc. When researching the employer for a verification of employment, several of them are listed within yellowpages.com and have other online references. If you're not employed year-round, but instead work a seasonal job every year, you usually have to provide more than your check stubs as proof of income and employment. This means extra documentation such as bank statements and tax returns, typically for at least three years.

This is because lenders need to know that you can continue to make the loan payments during the off-season. If you earn unemployment during that time, it can't be used as proof of income . Now employment background check about credit score has become an integral part in the interview phase carried out by the human resource team. As bad credit implies bad intention, you may leave a negative impression for having specified settled dues for several credit accounts. The credit report also highlights the pile of debts, if any and it will leave a dent on the applicant's work profile. Now, the person with debt trap is not likely to be eligible for an efficient employment.

However, this logic goes against the people who suffer from a wrong entry in a credit report or identity theft. The practice of checking CIBIL score is now finding establishing marks, but Information Technology sector opts for CIBIL score report check more often. The new employees generally have the tendency to spend the entire month's salary within a short period. They mainly struggle to get their finances on the track after starting to earn on a regular basis. In a few days, they are in huge credit card debts resulting in negative impact on CIBIL score. Thus begins the journey of new employees to seek jobs with a high payroll and keep their heads above the sea of debts.

However, the cumulative figure of continual rejection gets bigger and the burden of poor CIBIL score decreases job prospect. Verification Of Employment is how lenders verify the borrower is employed with a particular company and the official wages they make. Verification of employment, often referred to as VOE, is done during the mortgage process. Written VOEs and Verbal VOE. The lender contacts the borrower's employer and verifies the employment and payroll information of the borrower.

The HR department is the department that will do verification of employment. There are instances where a borrower's employment and/or payroll information can be confusing due to one or more reasons where the loan officer should get a VOE prior to issuing a pre-approval letter. The mortgage underwriting process typically takes between 45 and 60 days to complete. Because your credit report changes once a month, your lender checks it again prior to closing to ensure that your financial circumstances haven't changed.

Your lender will also reverify your employment at the end of the underwriting process to ensure you're still employed. This second verification could occur on the day of the closing and a job loss or change of jobs could derail the entire mortgage process. Overall, the consequences that can come with lying on a loan application — everything from a lowered credit score to jail time — aren't worth the rewards.

Instead of lying to get a bigger loan, shop around for lenders that can give you the most money based on your current financial situation. There are lenders out there that offer bad-credit loans, low-interest-rate loans and personal loans that take more than just your income and credit into account. The CIBIL report is a financial report that has details of your borrowings from banks and financial institutions. It keeps a track of details related to your loans and credit cards history. It also keeps a track of your payments, late payments, duration of the loan, etc. It seems very unlikely, but some companies in a few sectors, may check your CIBIL report and score before they interview you for jobs.

Many companies feel that the financial health of an individual is indicative of many personal attributes such as honesty, reliability and organization skills. Underwriting—the process by which mortgage lenders verify your assets, and check your credit scores and tax returns before you get a home loan—can take as little as two to three days. Typically, though, it takes over a week for a loan officer or lender to complete. Most mortgage borrowers rely on employment-based income to pay for a home loan. Mortgage lenders usually verify the amount and stability of income used to qualify for a purchase or refinance loan.

The requirement for last-minute verification of employment before closing generally depends on the lender, the loan program and your employment type. Lenders also verify your employment status via recent income documentation. Filling out a loan application shouldn't be a scary process and worrying about employer verification should not keep you from getting the money you need. Some lenders may verify employment and bank statements but your chances are pretty good that they'll only look at your credit report and score. If you plan to change jobs during the mortgage application process, it is important to tell your lender as early on as possible.

Do Loan Companies Verify Employment Even once your loan has been approved, be cautious about changing employment. Many lenders will do a final check to verify your employment and income haven't changed since your final loan approval was issued. Days of stated income and no income verification are long over to qualify for a mortgage. If they have documented income, they can qualify for a mortgage loan. If home buyers have great credit but no documented income, they will not qualify for a home loan.

Documented income is the most important factor in qualifying for a mortgage Lenders want to be assured borrowers have the right amount of income. This is so they are able to afford the new proposed monthly housing payment which is referred to as PITI. Lenders want to make sure new homeowners can afford minimum debt obligations without stress. Mortgage underwriters also need to be assured that the income is likely to continue for the next three years or more. Verification of Employment will be done not just with the current employer but also with past employers as well to document they have a two-year employment history. Ditching the paper chase and phone tag is great, but you still need an accurate report of your borrowers' income and employment to effectively assess risk and ensure they can reliably make payments.

Our easy-to-read income and employment verification reports give you all the real-time financial data you need, even from multiple data sources. In 2020, Fannie Mae issued a fraud alert warning mortgage lenders about nonexistent companies listed on loan applications. The original wave of fake employers were located throughout California. Several of them are listed within yellowpages.com and have other online references.

When you submit a mortgage loan application, your lender must verify that you have sufficient income to take on the new debt. Lenders therefore contact your employer to verify your employment; this normally occurs after you receive your preliminary approval for the loan. However, the mortgage loan process can take weeks or even months so lenders typically reverify your employment prior to the loan's closing. The CIBIL score is 3-digit number, anywhere between 300 and 900, and is meant to provide a brief report of your past performance in payment of loans and credit card bills. This report summarizes your loan and credit transactions with each and every bank and financial company, and focuses on a certain period of time.

Simply put, the CIR is your credit report whereas your CIBIL score is the credit ranking you get, based on the performance as shown in your CIR. Your CIBIL score is an excellent way to determine your financial condition. They may contain incorrect information that could bring down your score.

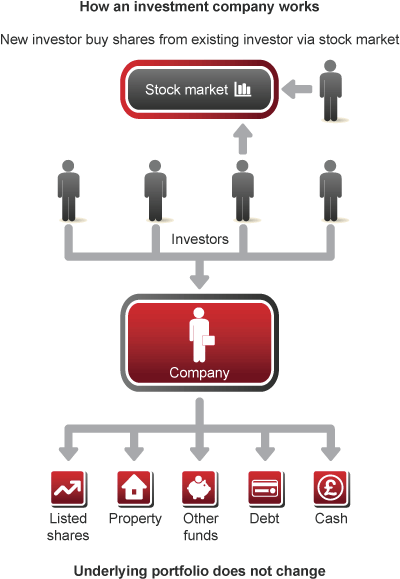

For example, the report may indicate late payments that weren't actually late, or it may feature a credit card that doesn't belong to you. Draft a written inquiry that highlights any disputes and provides documentation that supports your claims, such as copies of payments that have been processed to your accounts. Send the inquiry to the credit report company through certified mail. As you can see, a high credit score can save you thousands of dollars in interest because lenders and other financial institutions use credit scores to determine borrower liability. Those who have a higher credit score are less of a risk for lenders, as their credit history reflects that they are more likely to make timely payments. Those who have lower credit scores present a greater risk, as their credit history reflects that they are more likely to miss payments.

Since lenders have more confidence that individuals with a high credit score will better manage their financial obligations, they are "rewarded" with lower interest rates. Lenders have less confidence in individuals who have lower credit scores, and to protect themselves, they charge a higher interest rate. This includes the process of verifying your sources of employment and income, as well as the other details provided on your loan application. Before diving into employment and credit laws, let's dispel a myth that's been perpetuated online. When you hear things like "a bad credit score can prevent you from getting a job," it's actually not true. That's because employers don't pull your actual credit scores like a lender might, says Griffin.

" can only check a limited version of your credit report, and you have to give expressed written permission," he says. Now that you've found a house, negotiated and signed a contract, you'll begin your official loan application. Banks and finance companies verify income for auto loans for marginal applicants by reviewing proof of earnings documents provided by the individual. Lenders might look at offer letters, recent paystubs, tax returns, W2 forms, and bank statements but rarely consider sources that legally bar wage garnishment. Your credit report details your credit history, including any credit card account information, your balances, your available credit and your payment history.

Your credit score is a 3-digit number that basically sums up that information into a rating. A good credit score means you're a good credit risk , whereas a low credit score means you're a poor credit risk. You must include income information on your mortgage loan application. Your lender uses the information provided, such as your stated annual income, to make a preliminary decision on your application. Your lender compares your stated income with the debt levels shown on your credit report and calculates your debt-to-income ratio.

If you have enough income and satisfactory credit then you get a preliminary approval. Credit bureaus usually have records pertaining to your employment and can provide your lender with an estimate of your annual income. However, credit bureaus don't always have up-to-date information so your lender must contact your employer to find out if you're still employed. The general rule has been that lenders prefer to work with borrowers who have worked in the same field for at least two years. But this rule comes with more leeway than do other underwriting requirements.

Because of this, mortgage lenders are more willing to overlook a job history filled with fresh starts in new careers than they are a low credit score or a high debt-to-income ratio. Informative Research is an innovative technology solutions leader that serves over 500 mortgage companies, banks, and lenders across the United States. As a Tier 1 CRA and Verification Service Provider, Informative Research is renowned for substantially streamlining the loan process through automation and progressive rules-based solutions. For example, our Verification Bundle allows a lender to combine any of IR's solutions and data partners into one invoice with a more affordable, straightforward credit report fee. As the only company in the industry that holds 3 security certifications, IR is committed to protecting client data and celebrates over 70 years of operational and technological excellence.

You'd think supplying your pay stubs and bank statements would be enough to prove to mortgage lenders that you own and earn enough to qualify for your home loan. And that used to be true until technology made it easy for anyone to dummy up phony documents. Unlike applications for mortgages and car loans, credit card applications don't ask for documented proof of income or employment. The bank that issued the card won't call your employer, but if you fall behind on payments on a credit card you're using, a debt collector has the right to contact your employer.

Gathering sufficient verification of employment – VOE – information can be a challenge. Employers may not have the staff to accurately and promptly complete the VOE, and human resource departments can delay the process of returning the VOE to your lender. Such programs can automatically request a VOE from your employer based on the information the system populates from your loan application.

In the event your employer provides income or employment information that differs from what you provided, the lender uses the information verified by your employer. Such disparities can raise debt ratios and lower your borrowing power. Whether you are applying for a personal loan, guarantor loan or payday loans online, with any loan application, you will typically have to provide details of your employment. These details can help the lender assess whether you're financially capable to manage the loan repayments.

If your employment details show that you earn enough and are in a stable job, you may have more of a chance of success with the application. Even if you're having trouble qualifying for a loan with one lender, you're not out of the running for all loans. For example, there are some lenders that offer loans specifically for borrowers with bad credit, while other lenders may specialize in loans for students or loans for members of the military. When you work with a specialized lender, you are more likely to gain approval on a loan that actually works for you. You may pay a little more in fees or have higher interest rates, but you won't have to risk lying on your application just to get approved.